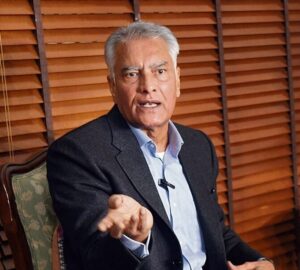

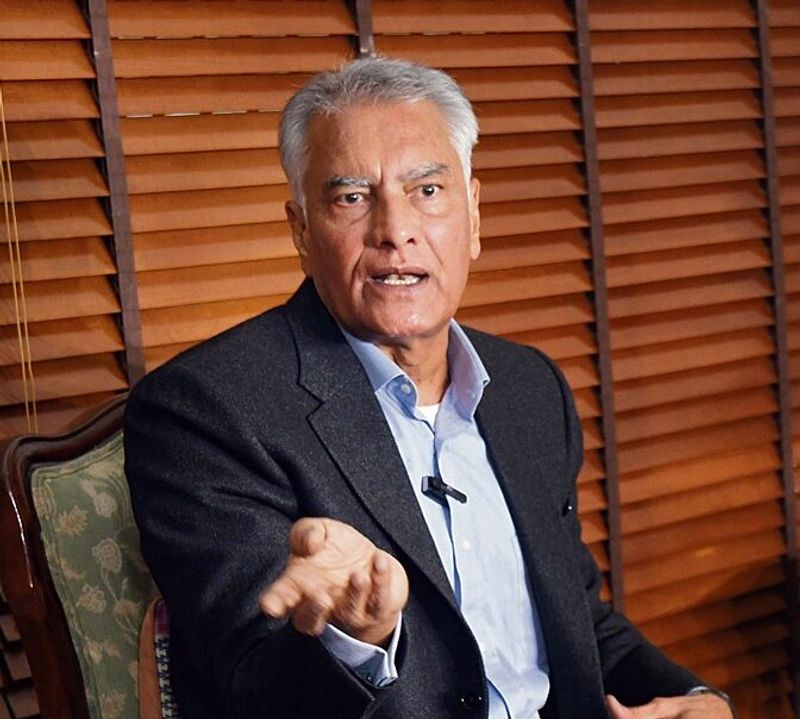

Artificial intelligence is rapidly emerging as the backbone of trust, fraud prevention and financial inclusion in the banking, financial services and insurance (BFSI) ecosystem, industry leaders said at a session of the India AI Impact Summit focused on “AI for Fraud Prevention and Financial Inclusion”.Delivering the keynote industry perspective, Suresh Sethi of Protean eGov Technologies underscored that India’s population-scale digital financial infrastructure now requires equally scalable, intelligent safeguards.“With transaction velocity rising exponentially, rule-based mechanisms are no longer sufficient,” Sethi said, pointing to UPI crossing 20 billion monthly transactions. “Fraud happens in milliseconds. Post-facto detection is simply not enough. We need real-time, in-flight intelligence,” he added.He argued that AI must evolve from a monitoring tool into a foundational trust infrastructure embedded across financial rails, from onboarding to transactions and network monitoring.Explaining the shift, Sethi highlighted three pillars: speed, network intelligence and data integration. AI systems, he said, could detect behavioural anomalies across accounts, identify mule networks and surface systemic fraud risks that static systems miss. “Our defences are fragmented, but fraud is connected. AI enables institutions to see risk across ecosystems, not in silos,” he noted.He also stressed that scaling AI was less a technology problem and more a mindset shift. “We often demand zero error from machines while tolerating human error. AI systems learn and improve. We must allow them to scale.”The session also explored cross-border cooperation, particularly India-Singapore collaboration, in building shared fraud intelligence infrastructure. Sethi suggested programmable registries and anonymised data-sharing frameworks to track mule accounts and strengthen digital financial corridors.Other speakers echoed the governance imperative. A senior banking executive on the panel stressed that AI deployment in regulated finance must remain explainable and accountable.“Every AI decision must be justifiable, contestable and traceable,” he said, outlining the need for transparency for customers, audit trails for auditors and oversight for regulators.Panellists also highlighted the balance between security and inclusion. Stronger fraud controls, they cautioned, must not create friction for first-time users or MSMEs. Tiered onboarding, contextual authentication and adaptive safeguards were cited as ways to protect users without excluding them.From a capital markets perspective, another industry participant noted that trusted AI infrastructure could transform credit allocation and financial inclusion. “If you have trusted data and trusted models, you create trusted capital allocation, and inclusion follows,” he said.The discussion converged on a common theme: AI’s role in finance is moving beyond automation to systemic transformation, embedding trust, enabling inclusion and safeguarding digital economies at scale.