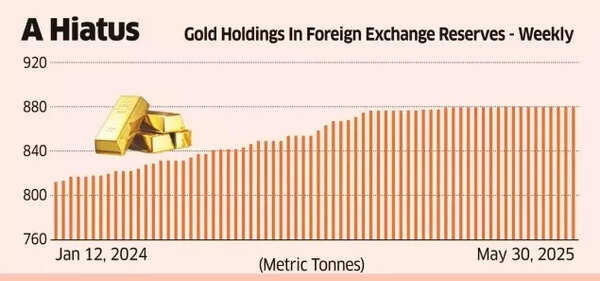

RBI's gold holdings remain stable at 880 metric tonnes from end-March through end May this year. (AI image)

The Reserve Bank of India (RBI) has maintained its current gold reserves without additions so far in FY26, potentially linking its acquisition strategy to anticipated downward price movements in this safe-haven commodity.

Gold prices have risen 80% over five years due to global trade and political instability. According to recent data, the RBI's gold holdings remain stable at 880 metric tonnes from end-March through end May this year.This represents the most extended period without purchases in over a year. Previously, acquisitions were suspended during October-December 2023, with holdings remaining constant at 804 metric tonnes throughout that period, according to an ET report.

Why Is RBI Not Adding to India’s Gold Reserves Right Now?

The central bank's current stance appears to be influenced by various market analyses. Price projections from Citi, a Fitch research division, Motilal Oswal Securities and ICICI Bank suggest a decline from $3,445 per troy ounce, citing potential reduction in global political tensions and anticipated interest rate reductions by the US Federal Reserve.

Gold Holdings in Foreign Exchange Reserves

Central bankers are increasingly favouring gold investments, according to a World Gold Council (WGC) survey conducted in mid-June.

The study, which included responses from approximately half of all central banks, indicated that 95% of participants anticipate global sovereign reserve managers will expand their gold holdings over the next 12 months, an increase from 81% in the previous year. "Gold's performance during times of crisis, its use as an effective portfolio diversifier, and its role as a long-term store of value were the top three most relevant reasons for central banks to hold gold," the respondents to the WGC survey said according to the financial daily’s report.Also Read | Gold a darling investment not just for Indian households! Why corporates are investing big in gold ETFs - explainedThe WGC's 'Trends in Reserve Management 2024' survey highlighted that reserve managers consider geopolitical escalation as their primary concern. The increasing number of geopolitical conflicts has brought attention to the vulnerability of reserves to sanctions, which can restrict access to and utilisation of foreign assets. In this context, reserve managers consider gold as their most secure investment alternative."Reserve managers worldwide allocate their holdings into distinct categories, including a liquidity tranche for immediate requirements and an investment tranche aimed at generating enhanced returns," stated a research analysis in the central bank's most recent annual report. "Gold's property of being a safe-haven asset has led to significant gold purchases by central banks."According to RBI's latest annual report, gold's proportion within net foreign assets rose to 12% at end-March 2025, compared with 8.3% at end-March 2024.

3 hours ago

1

3 hours ago

1

English (US) ·

English (US) ·